The Herald ran an article today about the possibility of a cashless society. Apparently 24% of Australians would welcome this prospect. In a classic piece of narrative manipulation and deflection, the writer frames the debate around this issue in terms of which groups might be disadvantaged by folk having no cash on hand - waiters hoping for tips, street charity collectors, etc. They also point to the poorest folk who may not have bank accounts - the homeless, the less fortunate, etc. What they fail to point out, another elephant in the mainstream media’s living room, is that the real reason we are being softened up for a cashless society is ........control.

What the MSM is doing here is getting you to think of the relentless trend towards a cashless society as a) inevitable, b) convenient and desirable overall, and c) only problematic in situations which can no doubt be fixed with a bigger welfare state, a higher minimum wage and, a bit more government :). What the debate should be around is the level of control over the people and their dependence on the system.

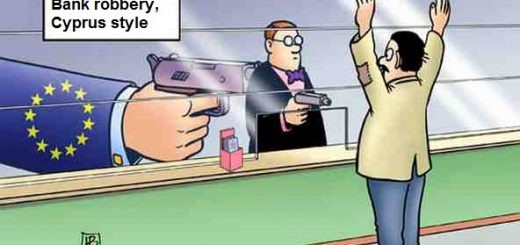

Three examples should give us pause for thought. Firstly, bank bail-ins. A few years ago, in the wake of the financial crisis, legislation was introduced around the world to allow bank ‘bail-ins’. This essentially means that, in the event of a potential bank collapse, the bank can freeze a portion of depositors funds and, if necessary, use them to bail out the bank. In New Zealand, it’s known as the Open Bank Resolution. As with many pieces of government legislation, it’s titled so as to lead you to believe its’ purpose is the exact opposite of what it’s really about. The suggestion is that the OBR will help to keep banks open and give you access to more of your funds than you would have in the event of a full blown liquidation. The reality is that it gives the bank the right to help itself to your funds. Clearly the more funds are held in cash the less power and control the banking system has over people in this event.

Secondly, tax payments. Have a dispute with the IRD ? Got some arrears ? It’s not difficult to see the increased ease and convenience for the tax collectors of having all funds held electronically when they want to garnish someone’s account. Note also how we have less banks than we used to. The vast majority of people bank with a small handful of big banks. The ANZ and National merging a few years ago made this situation worse. Imagine a completely cashless society and then imagine if we all end up having to bank with the same bank. The government decides to introduce some new, unpopular tax ? No problem. Perhaps when you sign up for the bank account you’ll have to sign something which gives the bank permission to deduct all such payments on notice from the relevant authority. You might think this is far fetched, but notice how everything gradually inches towards ever-more centralisation and control.

This brings us to the third issue. Cutting people off from the system. What if you fall foul of the system and it decides to cut you off ? What are you going to do ? How will you survive ? There are parallels here with the internet. Everything is now online, it seems. This is great for convenience and has empowered many people. Now, however, we see governments taking steps to control the internet. What we can see, what we can say, etc. We are sold the idea of everyone having a unique identity online. RealME and so on. Again, it’s sold to us on the basis of safety. Controlling terrorism or online child porn or drug trafficking. Really, though, it’s about controlling you and me. In a world where you can’t function properly without internet access, getting cut off from online access would be tantamount to a death sentence. Combine complete online dependence with a completely cashless society and the state will have complete control over our lives.